Committee Blog: Discovering the Potency of Data – How Cannabis Brands Can Harness Audience Insights to Elevate Success

In the rapidly evolving landscape of the cannabis industry, understanding your audience is critical to staying ahead of the curve. For brands, this can be difficult given retailers hold the keys to their customer data. However, through the utilization of digital marketing, cannabis brands have the opportunity to glean invaluable insights from their audience data. In this comprehensive breakdown, we’ll explore how cannabis brands can leverage audience data from programmatic advertising, email campaigns, SEO and more to gain a deeper understanding of their customers and enhance their overall success.

The Power of Data in the Cannabis Industry

Data is the cornerstone of informed decision-making, and in the cannabis industry, with its regulatory restrictions and shifting consumer preferences, its importance cannot be overstated. By harnessing audience data from digital marketing campaigns, cannabis brands can move beyond conjecture and gain actionable insights into their customers’ behaviors, preferences, and needs.

Analyzing Audience Demographics

One of the primary benefits of digital marketing is the ability to gather detailed demographic information about your audience. Through tools like Google Analytics, social media insights, campaign reports, and customer relationship management (CRM) platforms, cannabis brands can paint a vivid picture of their customer base. From age and gender to location and interests, this demographic data provides invaluable insights into who your customers are and how best to engage with them.

Understanding Consumer Behavior

Beyond demographic data, digital marketing campaigns offer a window into consumer behavior. By tracking website traffic, engagement metrics, and conversion rates, cannabis brands can gain a deeper understanding of how customers interact with their brand online. This insight allows brands to identify trends, uncover pain points, and optimize their digital presence to better meet the needs of their audience.

Personalizing the Customer Experience

One of the most powerful applications of audience data is in personalizing the customer experience. By segmenting their audience based on demographic information, cannabis brands can tailor their messaging and offerings to resonate with individual customers. Whether through targeted email campaigns, customized product recommendations, or educational content, this level of personalization not only enhances the customer experience but also drives engagement and loyalty.

Optimizing Marketing Strategies

Audience data also serves as a compass for guiding marketing strategies in the cannabis industry. By analyzing the performance of various marketing channels, content types, and messaging approaches, brands can identify what resonates most with their audience and allocate resources accordingly. Whether it’s investing more heavily in content creation, refining digital advertising tactics, or experimenting with email campaigns, data-driven insights enable brands to optimize their marketing efforts for maximum impact.

Predicting Trends and Forecasting Demand

In addition to informing day-to-day marketing decisions, audience data can also provide valuable insights into larger industry trends and consumer preferences. By analyzing macro-level data trends across their customer base, cannabis brands can identify emerging market opportunities, anticipate shifts in demand, and stay ahead of the curve. Whether it’s launching new product lines, expanding into new geographic areas, or pivoting to meet evolving consumer needs, data-driven forecasting empowers brands to make informed strategic decisions.

Enhancing Product Development

Finally, audience data can play a pivotal role in shaping product development strategies within the cannabis industry. By soliciting feedback from customers through surveys, reviews, and social media interactions, brands can gain valuable insights into product satisfaction, preferences, and needs. This feedback loop not only informs the development of new products but also enables brands to refine existing offerings based on real-time customer input, ensuring that their products remain relevant and competitive in a rapidly evolving market.

Conclusion

In conclusion, audience data is a potent asset for cannabis brands seeking to unlock the full potential of their marketing efforts. By analyzing demographic information, understanding consumer behavior, personalizing the customer experience, optimizing marketing strategies, predicting trends, and enhancing product development, brands can gain a deeper understanding of their customers and elevate their overall success in the cannabis industry. As digital marketing opportunities continue to evolve, brands that harness the power of data will undoubtedly emerge as leaders in this dynamic and rapidly growing market.

Member Blog: Cannabis Convenience – Exploring the Rise of Delivery Services in Local Markets

by Erika Cruz, Outreach Monks

Remember the long lines and awkward whispers at the dispensary? Those days are fading faster than you can say “indica.” Cannabis delivery services are popping up around the corner, delivering your favorite flower, edibles, and more right to your door. This boom isn’t just about convenience, though. It’s about changing laws, new technology, and a growing desire for discreet, easy access to cannabis.

What’s particularly intriguing is the role of legislation in shaping this landscape. For instance, California voters approved Prop 64 or the Adult Use of Marijuana Act, allowing adults 21 yrs or more to legally grow, possess, and use cannabis for non-medical purposes. This state act not only welcomed statewide legalization but also allowed its 58 counties, including the city of Sacramento, the autonomy to develop their policies and regulations around cannabis retail, manufacturing, and cultivation. This decentralized approach has been instrumental in fostering the growth and diversity of California’s cannabis market, setting the stage for the rise of innovative delivery services.

So, what’s driving this surge in cannabis delivery service? In this article, we’ll dive into this question and discover how delivery services are not just changing the face of cannabis retail but also influencing consumer behavior and nurturing a sense of community among cannabis enthusiasts.

What is Cannabis E-commerce?

Cannabis e-commerce refers to the online retailing of cannabis products. This type of e-commerce operates within the legal frameworks of regions where cannabis is legally permitted for medicinal or recreational use. It involves various products derived from the cannabis plant, such as dried flowers, oils, edibles, and other related merchandise.

In cannabis e-commerce, consumers typically browse an online platform or website that lists available cannabis products. These platforms provide product descriptions, potency levels, usage instructions, and pricing information. Consumers can select products, add them to a virtual cart, and purchase online. The purchased items are then delivered to the consumer’s location, subject to legal regulations regarding delivery and distribution.

But if you are not sure which cannabis seller to trust, look for a seller who prioritizes safe, reliable, and convenient access to a diverse selection of cannabis products. For instance, Nexus Delivers in Sacramento is a notable choice to explore. Their dedication to quality, safety, and variety sets them apart as a trusted option in cannabis e-commerce.

Driving Forces Behind the Rise of Cannabis Delivery

1. Convenience and Discretion

Cannabis delivery brings your order discreetly to your door, on your schedule. Perfect for busy bees or privacy seekers, it’s the hassle-free high you crave. No crowds, no awkward stares, just pure convenience and the freedom to enjoy at your own pace.

Plus, discreet packaging and secure payment methods are essential components of this aspect. It involves ensuring that all transactions and deliveries are conducted with the utmost confidentiality, protecting consumers’ privacy.

2. Enhanced Product Selection and Information

Online platforms boast wider product selections compared to local dispensaries, often presenting detailed descriptions, reviews, and educational resources. This empowers consumers to make informed choices, discover new strains and products, and compare prices with transparency.

So, blast off from the dispensary doldrums and dive into the boundless knowledge and options offered by delivery – your perfect bud awaits.

3. Accessibility and Inclusivity

Accessibility means that consumers, regardless of their location, can easily browse and purchase cannabis products online. It breaks down geographical barriers, enabling those in remote areas or with limited mobility to access the benefits of cannabis.

Inclusivity goes beyond geographical access and emphasizes catering to a diverse clientele. It involves offering a range of products to suit various preferences and needs, including those seeking medicinal benefits. This means sellers can reach a broader audience and sell more.

4. Competition and Market Expansion

Delivery services play a pivotal role in fostering competition and driving market expansion in the cannabis industry. They act as catalysts, sparking a cycle of benefits for both businesses and consumers. By offering convenient and efficient delivery options, dispensaries are compelled to compete vigorously.

This competition has a twofold effect. Firstly, it exerts pressure on prices, forcing dispensaries to lower their rates to remain competitive. Secondly, it incentivizes dispensaries to enhance the quality of their cannabis products and elevate their customer service standards. As a result, consumers enjoy more affordable options, a wider array of top-notch products, and superior service.

Data and Marketing Opportunities

Delivery platforms gather valuable data on user preferences and consumption patterns, enabling targeted marketing and product development. This information forms the foundation for targeted marketing strategies. Dispensaries can personalize customer experiences, offering tailored product recommendations that align with individual tastes and needs.

Additionally, businesses can identify specific demographics and market segments, allowing them to effectively develop and fine-tune their product offerings to cater to these diverse groups.

Evolving Regulatory Landscape

Legitimate and licensed delivery services are emerging, and this transformation is creating a safer and more accountable cannabis industry.

These licensed delivery services play a crucial role in addressing various concerns. They prioritize safety by implementing robust age verification procedures, ensuring that only adults have access to cannabis products. Additionally, these services are actively involved in educational initiatives, promoting responsible consumption.

Conclusion

Remember, it’s not just about avoiding awkward stares at the dispensary; it’s about unlocking a universe of options from your couch. As this market blossoms, let’s keep it chill, responsible, and full of delicious possibilities. After all, who wouldn’t want a world where bud travels to you?

We appreciate your interest and hope you found this article valuable.

Member Blog: Pre-Rolls are Poised to Become the #1 Category in Canada – Will the Same Trends Follow in the US?

Earlier this year, we predicted that pre-rolls were destined to be the top-selling cannabis product by the end of this decade, and a new deep dive into the Canadian market has only further convinced us that pre-rolls are not only a cornerstone of the current market, but a major driver for future growth not only North of the Border, but in a federally legalized U.S. cannabis market as well.

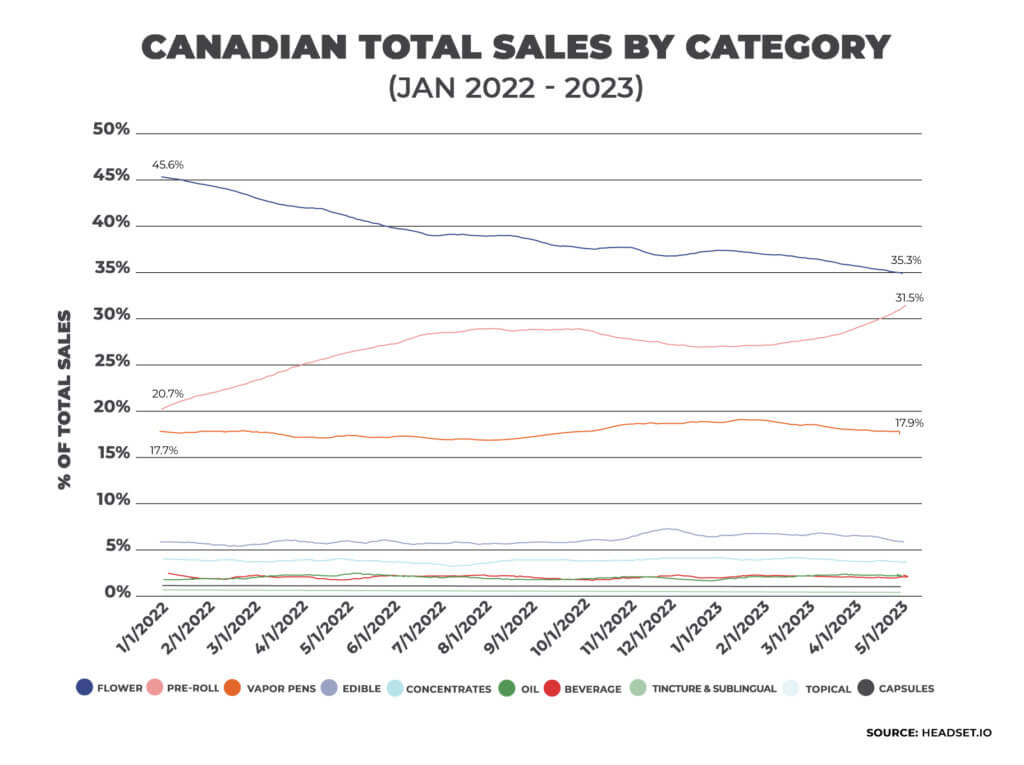

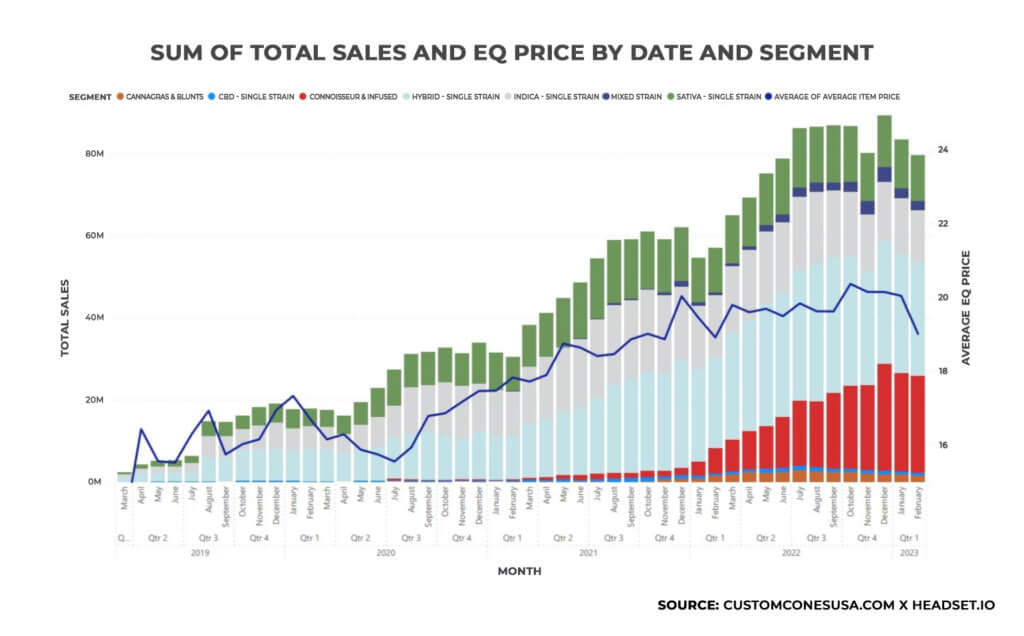

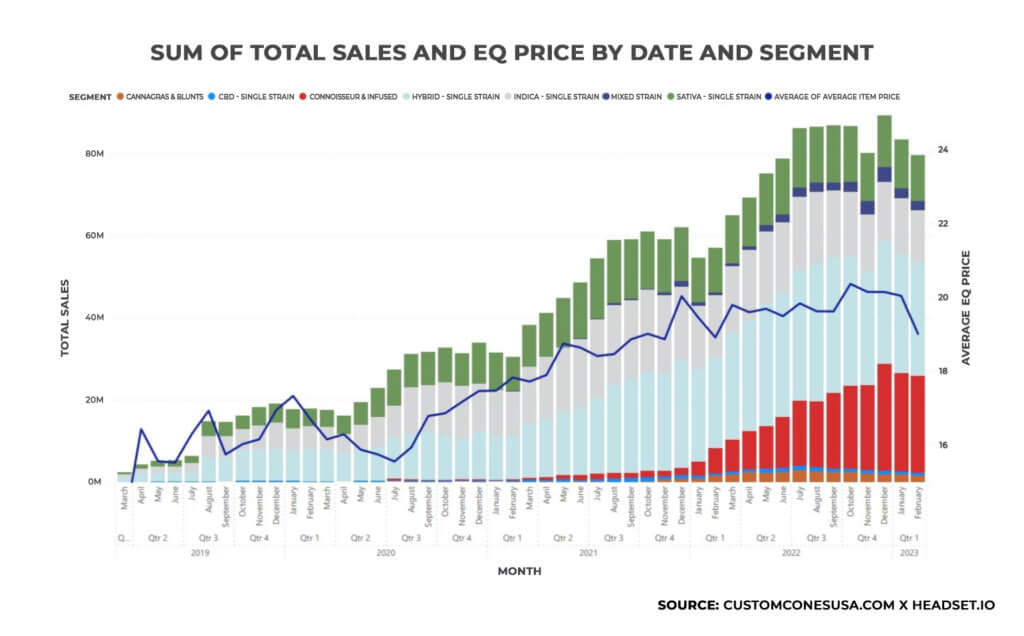

That’s because thanks in part to a staggering growth rate of 606% in infused pre-rolls from January 2022 to February 2023, pre-rolls are currently on the verge of overtaking flower as the top product category in Canada’s cannabis industry.

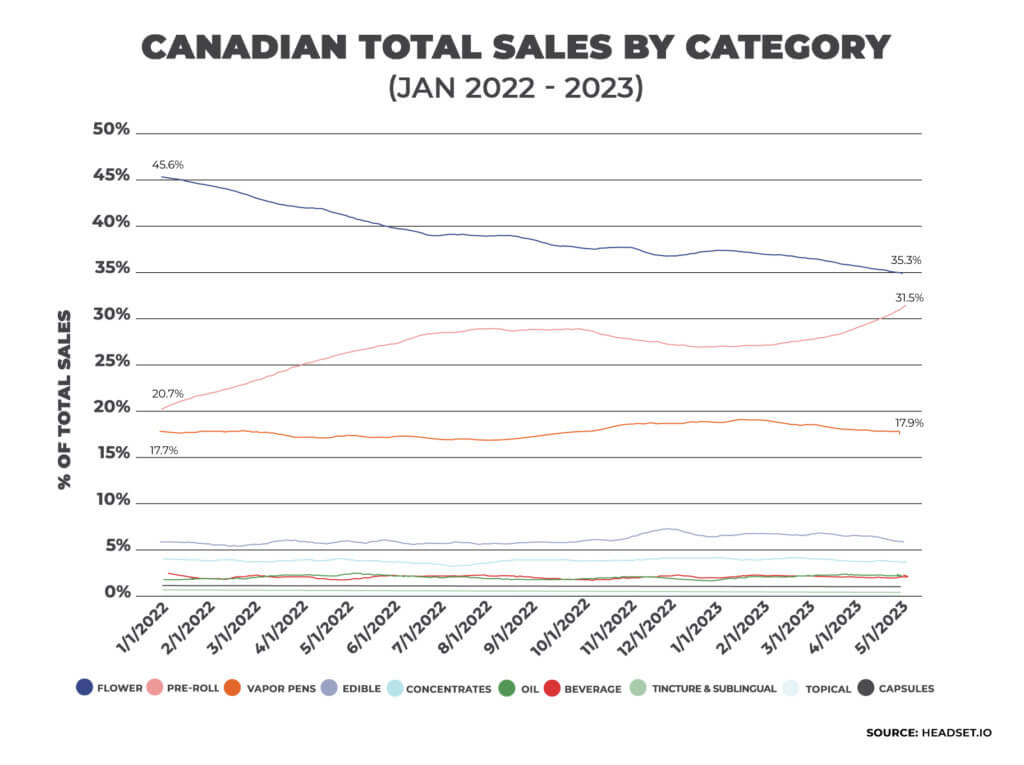

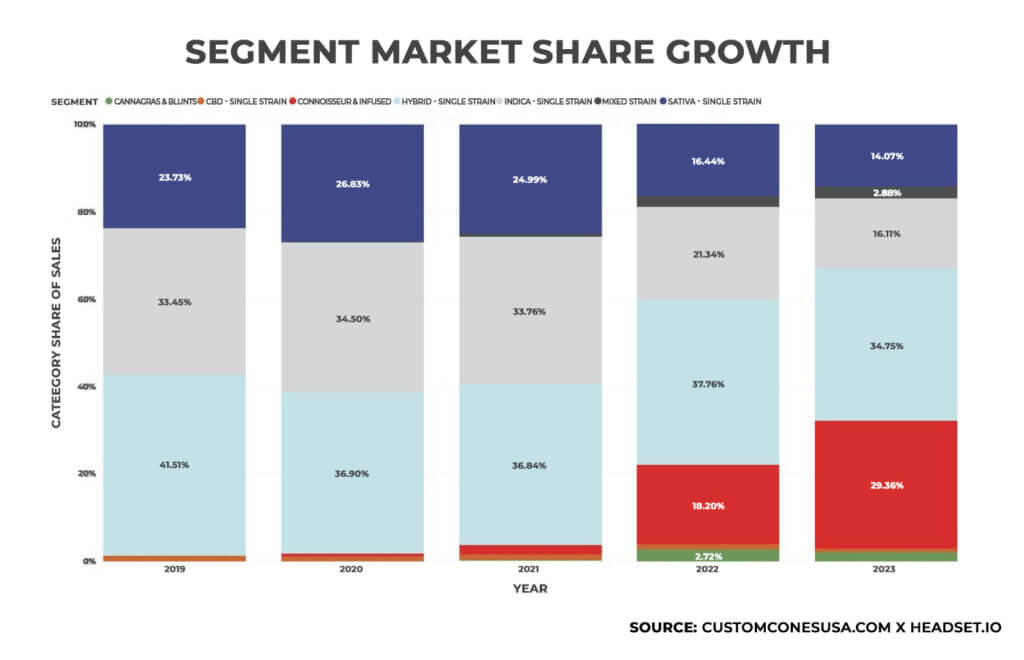

Using data from cannabis analytics firm Headset, our new White Paper, “Pre-Roll Growth in the Canadian Market,” details how pre-rolls in Canada have grown more than 50% over the past 18 months, from a 20.7% market share in early 2022 to a 31.5% total market share in May 2023, with total sales in the category topping CAD$1 billion in 2022. At the same time, flower sales in Canada continue to drop, falling to just 35% of sales in May 2023, compared to 31.5% for pre-rolls.

With federal legalization believed to be on the horizon for the United States, Canada’s data stands out as a national system and gives us some insight into how the American market could respond to a federal program, as opposed to one that is regulated state-by-state.

With federal legalization believed to be on the horizon for the United States, Canada’s data stands out as a national system and gives us some insight into how the American market could respond to a federal program, as opposed to one that is regulated state-by-state.

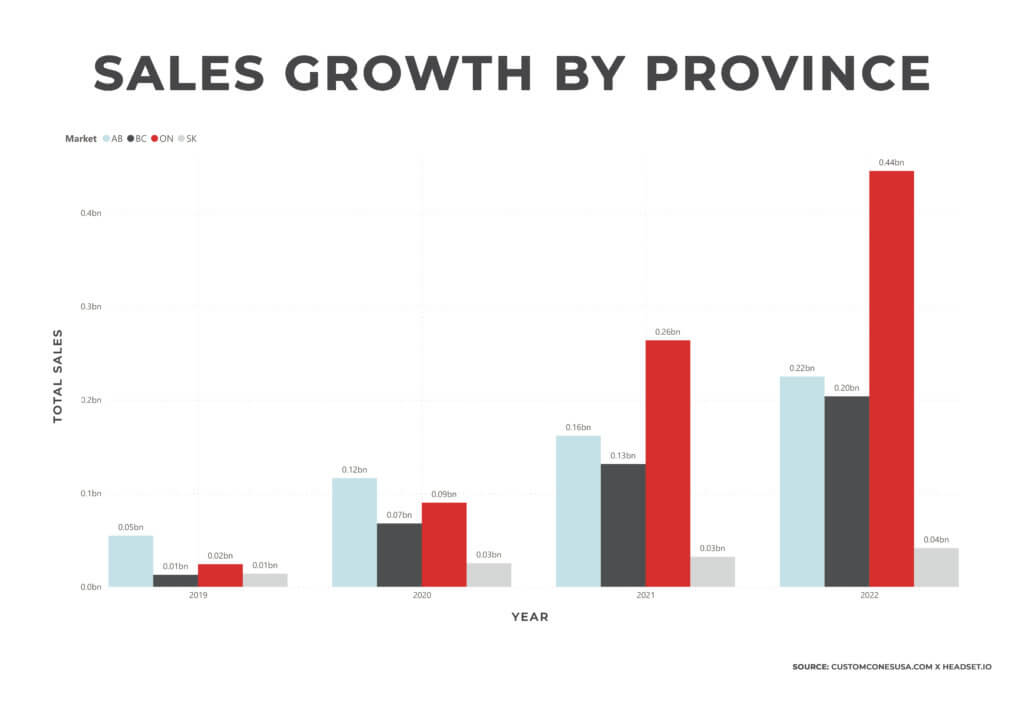

Growth in Every Market

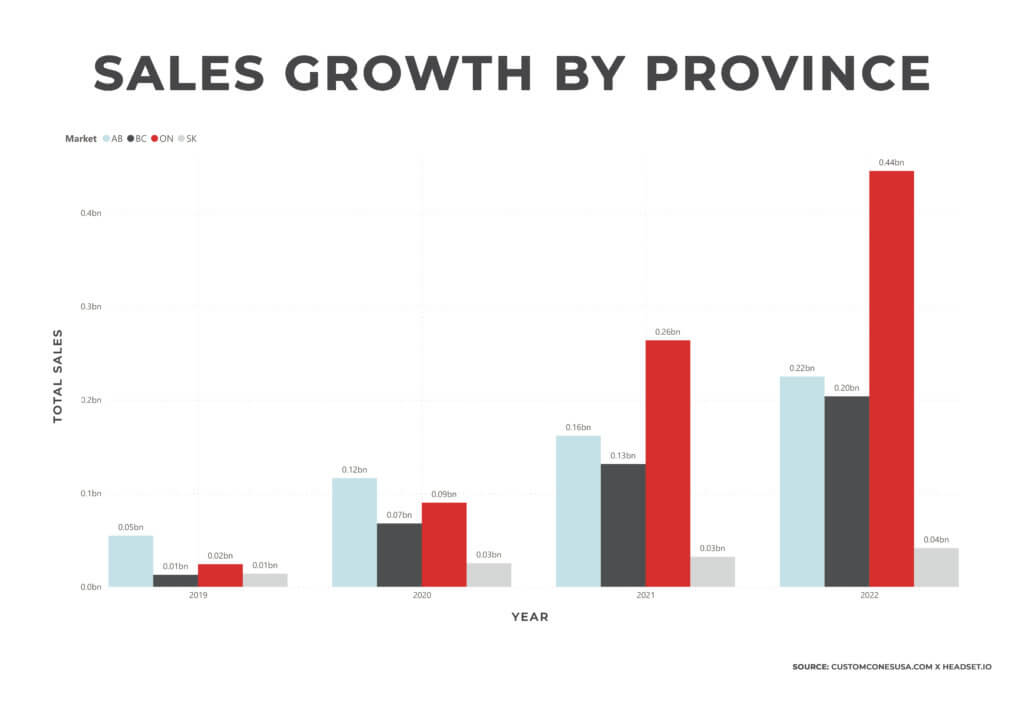

Sales of pre-rolls in all four of the provinces tracked by Headset saw large increases. Pre-roll sales saw 33% and 37% growth in Saskatchewan and Alberta, respectively, a nearly 54% growth in British Columbia and a whopping 69% increase in Ontario, the country’s most-populous province. In the U.S., pre-roll sales also continue to surge, growing to a 12.1% market share in the States.

The sales growth has been fueled in part by the rise of infused, or “connoisseur” pre-rolls, which combine a cannabis concentrate and flower into a single pre-roll cone. The result is a more potent pre-roll, often at a higher price point, which has helped push revenue totals even higher since Health Canada clarified its rules in late 2021 to clear the way for the product.

The sales growth has been fueled in part by the rise of infused, or “connoisseur” pre-rolls, which combine a cannabis concentrate and flower into a single pre-roll cone. The result is a more potent pre-roll, often at a higher price point, which has helped push revenue totals even higher since Health Canada clarified its rules in late 2021 to clear the way for the product.

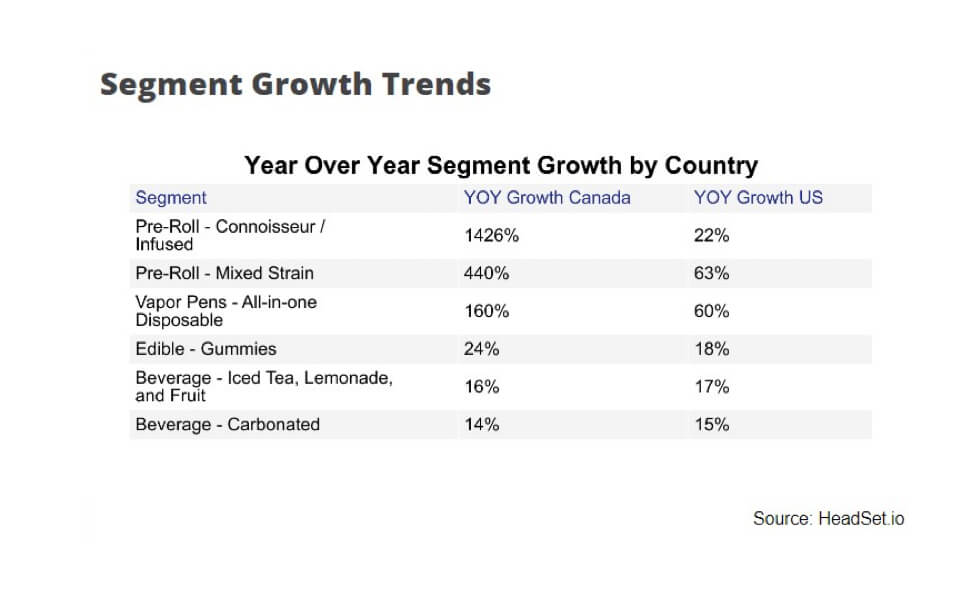

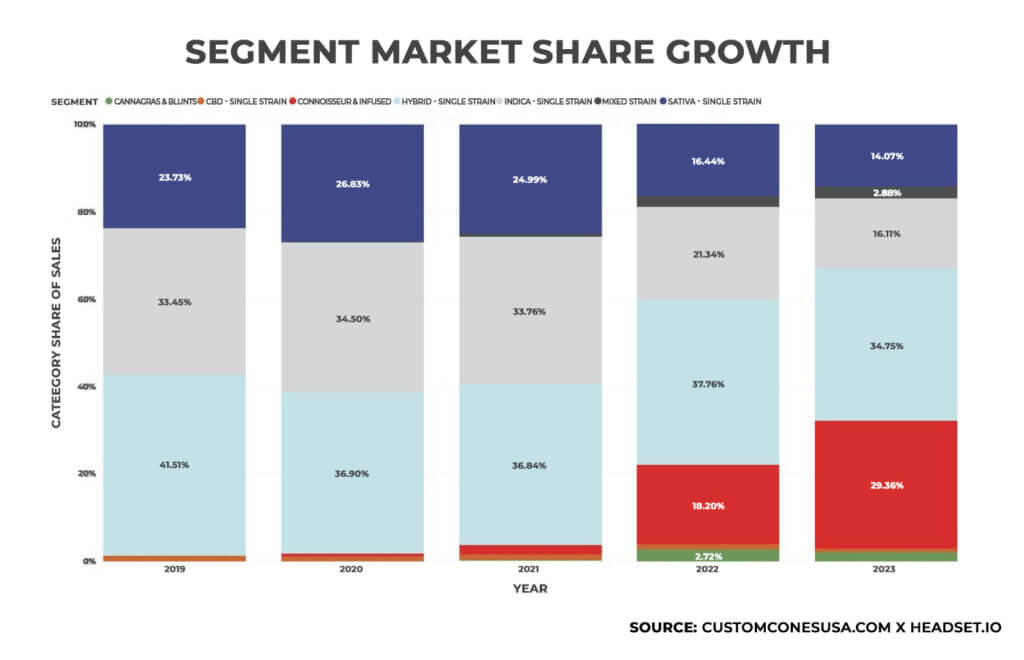

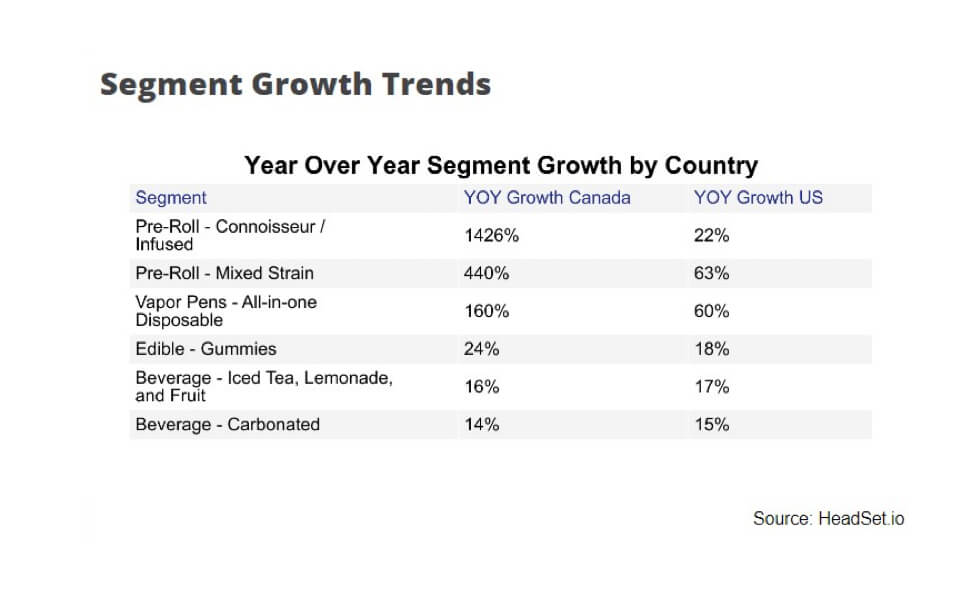

Consumers have responded, with infused pre-rolls seeing an eye-popping 1,426% growth rate from 2021 to 2022. The segment grew from just under 3% of the market at CAD$12.7 million in 2021 to nearly 30% and CAD$47.9 million by mid-2023. That’s more growth than any other pre-roll category except single-strain hybrids.

Keeping Price Points High

Keeping Price Points High

The rising popularity of infused pre-rolls, with their higher price point, has been a significant factor contributing to the increase in the average price of Canadian pre-rolls. Infused pre-roll sales jumped from 6.2% of total sales in January 2022 to 29.8% of sales by February 2023. This trend has been instrumental in maintaining the overall price of pre-rolls even as prices for flower and concentrates have decreased.

According to Headset data, in 2022, pre-roll products accounted for 27% of the new items introduced in the Canadian market, demonstrating a remarkable growth rate of 48.2% compared to 2021, second only to beverages. In response to the increasing demand in this category, a total of 1,870 new pre-roll products were launched in the Canadian market during that year.

The resilience of pre-roll prices can also partially be attributed to their manufactured nature and the unique attributes of infused pre-rolls. The demand for stronger pre-rolls, coupled with declining prices for flower and concentrates, has created a favorable environment for launching infused pre-roll products.

Additionally, automated pre-roll machinery continues to evolve, including new automated infused pre-roll machines, making it easier for manufacturers to produce large quantities of infused pre-rolls at a slight premium over regular pre-rolls, leading to the category’s rapid expansion.

Multi-Packs and Cross-Generational Appeal

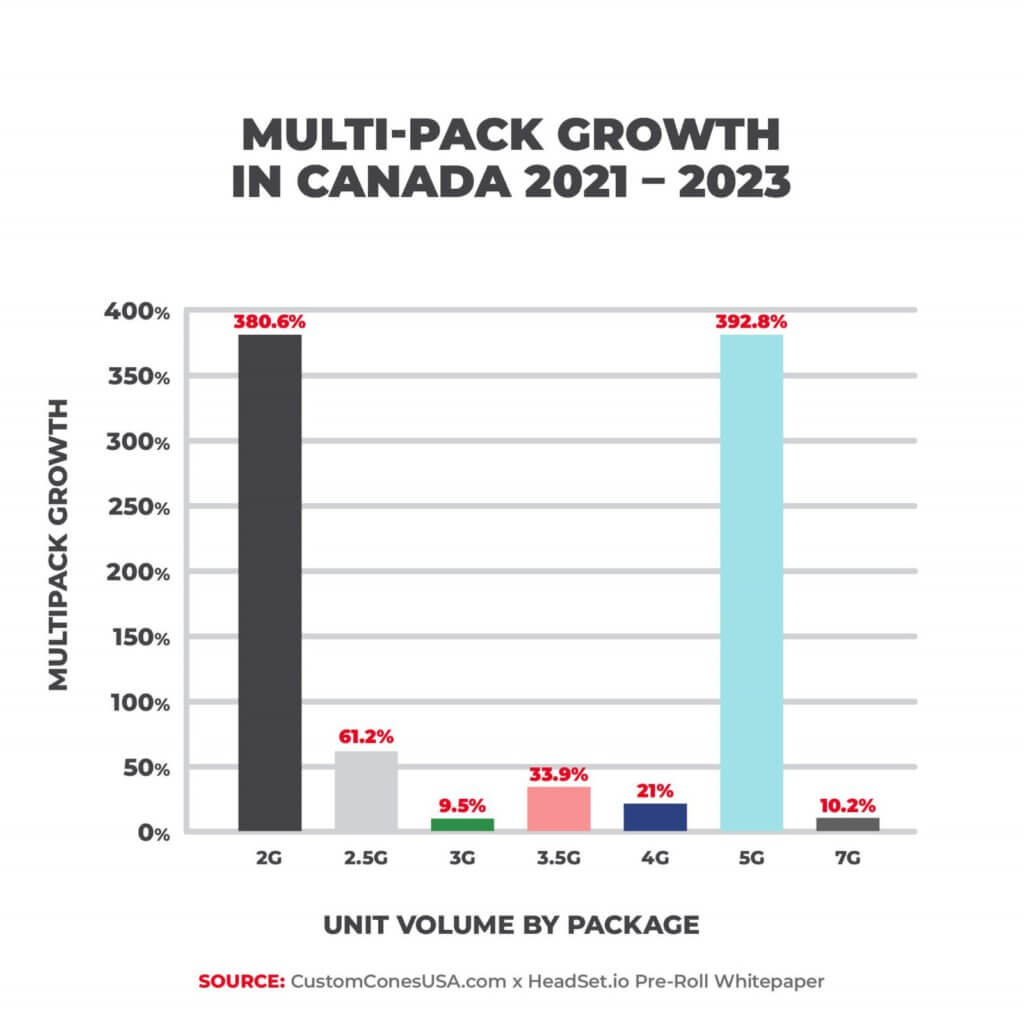

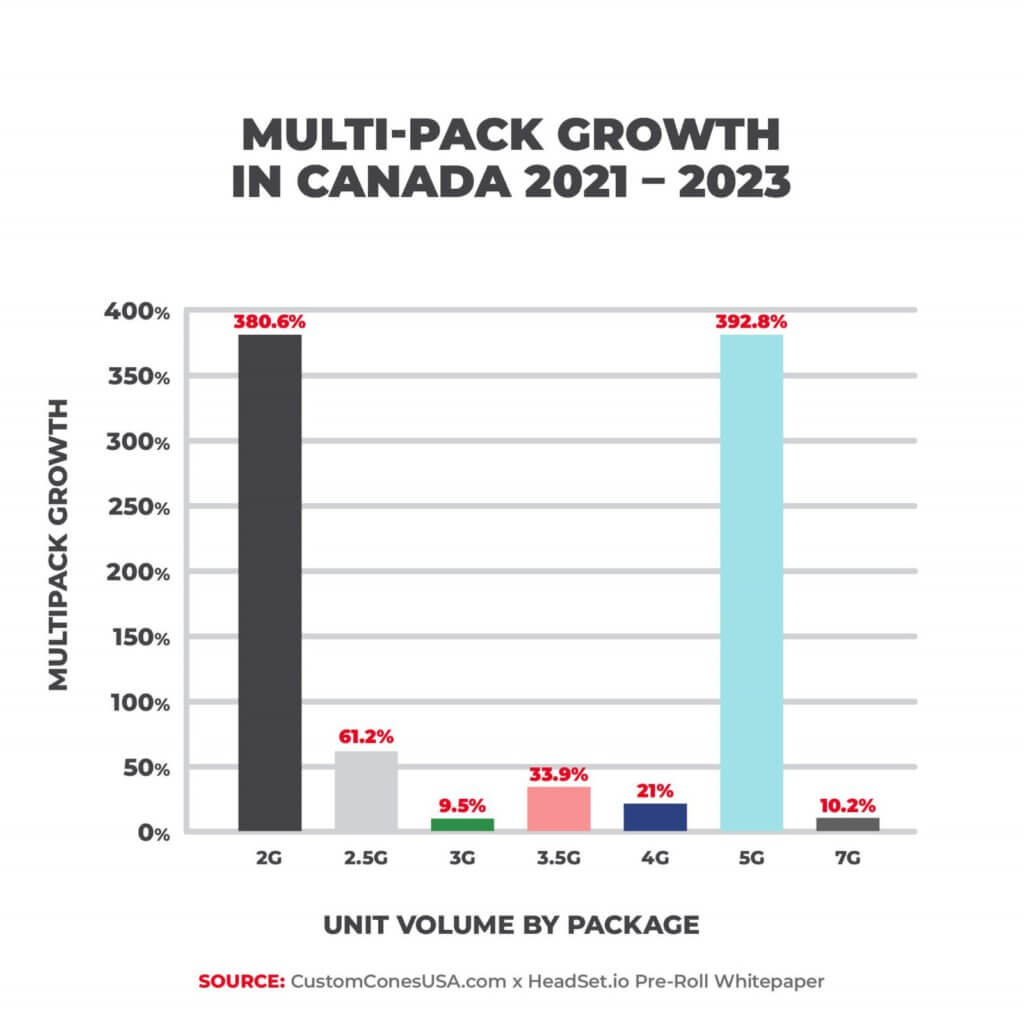

Other insights from our report include a surge in pre-roll multi-packs, with 2- and 5-gram packs seeing an almost 400% growth over the past two years, and that the pre-roll category shows less price compression than any other segment of the market, as it does in the U.S. as well.

Part of the strength of the pre-roll segment is its cross-generational appeal. For example, the Ontario market is the largest and fastest-growing of Canada’s provinces. With revenues reaching CAD$440 million in 2022, Ontario accounts for almost half of all sales in Canada. And within Ontario, the wallet share of pre-rolls grew within every generational group through 2021, with Gen X and Millennials seeing the largest growth, at around 45% each.

Within the fastest-growing group of consumers in the industry, Gen Z (which in Canada is a larger cohort than the U.S. due to a lower age restriction for cannabis purchases), pre-roll sales increased with both male and female consumers. The wallet share of pre-rolls among female buyers grew more than 4% to 20.4% in 2021. For males, the increase was even larger, growing from 14.6% of wallet share to 19.7%.

Final Thoughts on Pre-Roll Growth

The main factors driving the huge growth in pre-rolls are:

- Increased pre-roll quality, as flower and concentrate prices drop, so companies can create a higher quality pre-roll at cheaper and cheaper prices.

- Reduced labor costs, as advancements in pre-roll machinery help companies scale production and bring in automation.

- Consumer buying patterns showing that customers want convenience and are consuming for recreational use, not health and wellness.

The next big trend in pre-rolls, which will push pre-rolls to the No. 1 sales category in the industry, is freshness. Competing in the future will mean better packaging and a better supply chain, so pre-rolls are always fresh at retail.

But with sales surging across both Canada and the U.S., now is the right time for producer/processors to launch or expand pre-roll lines, particularly infused pre-rolls and pre-roll multi-packs.

For more information on how you can capitalize on the latest trends in the pre-roll segment, contact the Pre-Roll Experts at Custom Cones USA.

Member Blog: Should Business Decisions Be Based on Data or Intuition?

by Jonathan Monk, Managing Director at Most Consulting Group

The business world is a complicated place. At any given time, your company’s performance is influenced by various factors in both local and national economies. The business world’s inherent volatility is further exasperated in the cannabis industry – where opportunity always seems to be counterbalanced by excessive risk.

To find business success today, entrepreneurs pay careful attention to data related to consumer behavior, sales performance, and competitor analysis. While this logical approach to business seems like a surefire road to success, many people feel there is more to the story. Some of the most iconic entrepreneurs in history have followed their intuition as opposed to data.

Whether you are operating a new startup business or managing a well-established company, it’s always a good idea to reassess your approach to decision-making. In the cannabis industry and beyond, it is worth asking yourself: “should business decisions be based on data or intuition?”

Trusting Your Gut for Business Decisions

The notion of “trusting your gut” extends far beyond the business world. In fact, for time immemorial, people have trusted their instincts to ensure survival. As we have evolved into the modern world, people apply their gut instincts when making difficult business decisions.

Whether it be in the tech industry or the cannabis space, modern society celebrates visionary risk-takers who disrupt the norm. Of these impassioned entrepreneurs, there is perhaps no better example than Apple Founder Steve Jobs. The website Business.com quotes Jobs as saying, “You have to trust in something, your gut, your destiny, life, karma, whatever. This approach has never let me down, and it has made all the difference in my life.”

One of the exciting elements of intuitive decision-making is that this approach sometimes leads to excessive risk-taking. Importantly, in the business world and gambling, the mantra “the larger the risk, the larger the reward” rings true. Therefore, following your gut is an excellent method if you are looking to disrupt the cannabis industry with a game-changing product or service. This approach certainly paid off for Steve Jobs with Apple products such as the iPod, iPhone, and iPad.

Using Data for Decision-Making

As the legal cannabis industry continues to mature, we amass data on critical elements such as consumer behavior, business trends, and investor relations. Even more, as we carefully track the performance of companies around the nation, we uncover a good deal of data on what makes successful cannabis businesses “tick.”

Looking at the cannabis industry of 2021, there are near endless datasets that can be acquired in developing a logical roadmap to success. In an industry built on the unstable foundations of hyper-localized legalization and ever-changing regulations, this hard data often serves as a guiding light in the volatile waters of startup culture.

Data-driven decision-making also has its fair share of high-profile supporters. According to the Harvard Business School website, Google, Starbucks, and Amazon have relied heavily on data to develop their businesses’ essential parts. These fact-based business decisions have led to successful real estate acquisitions for Starbucks and industry-defining e-commerce practices at Amazon.

Unlike intuitive decision-making, using data to guide your choices often leads to less risky behavior. Yet, following the guidance of the risk/reward ratio, such conservative, data-driven decision-making will likely yield smaller financial rewards. Nonetheless, a stable cannabis business will continuously pay steady dividends far into the future.

The Hybrid Approach

While it would be nice to have a clear-cut answer on whether intuition or data is best for making business decisions, the world doesn’t work that way. To this end, there will always be situations where you should follow your gut. However, as a modern business owner, you will have difficulty staying ahead of the curve without paying careful heed to data.

To ensure the best possible course of action for your cannabis business, we recommend a hybrid approach to decision-making. With this synthesis of intuitive thought and logical analysis, you can develop a business plan that balances creativity with stability.

A great example of a hybrid approach to business decision-making can be seen with a new cannabis dispensary. This business should unquestionably follow as much data as possible with critical elements such as consumer behavior and product pricing. In turn, this hard data will inform conservative decisions that lead to sustained profits and increased stability.

After the dispensary has been operating for a while, it could be an excellent time to start thinking about more intuition-based decisions. Maybe you had a hunch that more grassroots marketing could set your dispensary apart from competitors? Or, perhaps it’s a good idea to try growing a new cannabis strain that nobody else has in your given market? Whatever your intuition tells you, it’s likely best to implement riskier business decisions only when you first develop some stability.

Conclusion

The business world is complex, and the cannabis industry is always changing. It’s impossible to implement one “blanket” solution for all decision-making scenarios. As such, we should pay careful attention to our predecessors to learn what types of solutions might work for our businesses.

Whether you are an intuitive risk-taker like Steve Jobs or a data-driven corporate entity such as Starbucks, you can always learn and evolve. In the end, the business world will always love and applaud those iconoclasts who overturn industries by shunning logic. Yet, we rarely hear about the thousands of entrepreneurs who’ve taken such risks and failed.

The cannabis industry further complicates notions of decision-making in the business world. With much uncertainty looming in the industry at all times, many cannabis companies value stability above all else. To this end, data-driven decision-making may veer beyond the realm of preference and into the realm of a necessity for most cannabis operators.

Jon Monk is the Managing Director at MOST, a marketing and consulting company that serves the cannabis, hemp, and related industries. He has a proven track record of leadership and business development in the marketing, finance, retail, and consumer products sectors. Jon can be reached at jmonk@mostcg.com for questions about marketing, advertising, and other aspects of cannabis business.

Jon Monk is the Managing Director at MOST, a marketing and consulting company that serves the cannabis, hemp, and related industries. He has a proven track record of leadership and business development in the marketing, finance, retail, and consumer products sectors. Jon can be reached at jmonk@mostcg.com for questions about marketing, advertising, and other aspects of cannabis business.

Keeping Price Points High

Keeping Price Points High

Jon Monk is the Managing Director at

Jon Monk is the Managing Director at

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

News & Resource Topics

–

This Just In

How THCa Vapes Are Changing Consumer

Announcing NCIA’s 2026-2028 Board of Directors